Financial Planning 19.04.23 - Stage three Tax Cuts

Stage three Tax Cuts

Click below to read the full report

Stage three Tax Cuts

Back in 2018/19 the Federal government passed an income tax package, which included numerous tax cuts that were designed to be introduced in stages over several years. The “Stage three” tax cuts are planned to take effect from 1st July 2024. We think it’s a good time to recap what this entails given the Federal Budget is also due to be released on the 9th May 2023.

How the Stage three tax cuts will work

The Stage three tax cuts focused on adjusting marginal tax brackets. The objective was to update tax bracket thresholds to counter inflation, with the aim to solve ‘bracket creep’ (which is where taxpayers move up the tax bracket due to their nominal income increasing over time due to inflation), something tax brackets don’t account for.

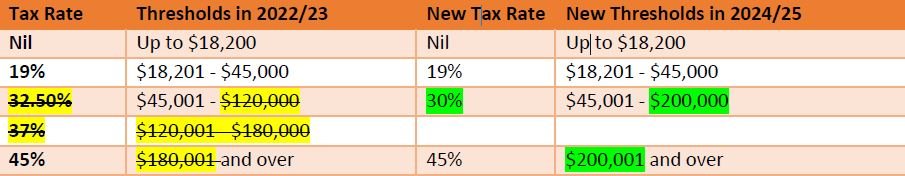

The changes are:

• The current 37% tax bracket will be removed.

• The existing 32.5% tax bracket will be lowered to 30%.

• The threshold for the top tax bracket will be raised from $180,001 to $200,001.

From the above table, you can see that everything up to $45,000 remains the same. Only when you reach $45,001 to $200,000, every dollar will now be taxed at 30 per cent and every dollar above $200,000 will now be taxed at 45 per cent.

Arguably, the adjustment has the biggest impact on high-income earners given some will now fall into the $45,001 - $200,000 bracket. Medium income earners also arguably gain a marginal benefit as their tax rate would drop from 32.5 per cent to 30 per cent. For most low-income earners, the stage three cuts will not have a big effect, as earnings below $45,000 remain taxed at the same rate.

LMITO – Low to Middle Income Tax Offset “The Lamington”

The government has pushed ahead with the planned removal of LMITO as of 30th June 2022. The tax offset was initially introduced as a temporary measure in the 2018-19 financial year as part of the government’s original three stage tax overhaul.

Last financial year this reduced eligible individuals’ taxable income by up to $1,500. The LMITO was never intended to be permanent, but was extended during COVID to help ease cost of living pressures.

The first two stages also raised the upper thresholds of the 19% and 32.5% brackets to $45,000 and $120,000 respectively.

Where to now?

“Structural issues” in the budget may force a backflip on the Stage three tax cuts, with estimates from the Grattan Institute noting they’ll cost around $20b a year from mid-2024, rising to $31b by 2030. The Stage three cuts are already legislated and were an election promise, campaigned by both sides and reaffirmed in October by Anthony Albanese.