Death, Taxes and Super

Click below to read the full report

Estate Planning – Death, Taxes and Super

Two weeks back in our weekly, we touched on Superannuation death benefits and nominations. Expanding on this topic, we will identify how tax is treated by the recipient/s of a Superannuation death benefit.

The Tax applied on a death benefit will depend on:

Whether the recipient/s is a Dependant of the deceased under Taxation Law.

Whether it is paid as a lump sum or Income stream.

Whether the super is tax-free or taxable and whether the member already paid tax on the taxable component.

The recipient’s age and the age of the deceased person when they passed (for income streams).

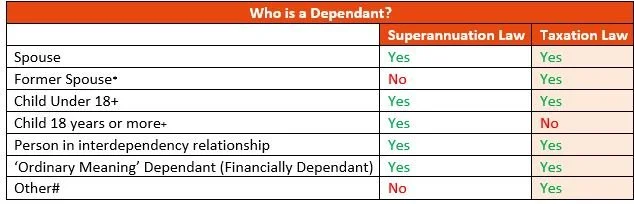

Superannuation Death Benefit – Who is a Dependant?

Firstly, you will need to identify who is classified as a ‘Dependant’ under Taxation Law, as this will decide the applicable tax treatment.

*'Spouse' includes a person (same or different sex) who's in a genuine domestic relationship as a couple or has a registered relationship under certain state and territory laws

+Child includes an adopted child, stepchild or ex-nuptial child, a child of the person’s spouse and a child as defined in the Family Law Act 1975

# Includes persons who receive a lump sum death benefit in relation to a death in the line of duty as a member of the Defence Forces, the Australian Federal Police, State or Territory Police Force or as a protective services officer

Superannuation Death Benefit – As an Income Stream

+ A death benefit pension paid to a child must cease by age 25 unless the child has a qualifying disability.

If a deceased estate receives the Superannuation death benefit, the estate pays tax on behalf of the beneficiaries of the death benefit. The amount of tax the estate must pay is the same as if the payment was paid directly to the beneficiaries. Taxation Law uses a ‘look through’ approach when death benefits are distributed to a deceased’s legal representative. This involves determining whether the final recipient/s of the Superannuation death benefit will be a Dependant or a Non-Dependant of the deceased.

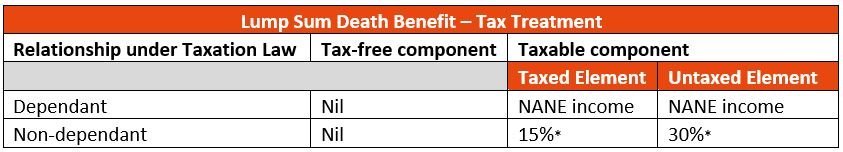

Identifying Superannuation components

The next step is identifying which components the Super is in:

Tax-free component

Taxable component the super has paid tax on (Taxed Element)

Taxable component the super has not paid tax on (Untaxed Element)

NANE – Non-Assessable Non-Exempt is income that is not assessed, nor exempt, and is therefore tax free.

*plus Medicare levy

*plus Medicare levy

Depending on the recipient of the funds, ‘the proportioning rule’ may need to be applied to calculate the tax applicable.

Final thoughts

The tax-free component of super attracts no tax when passed onto your beneficiaries. A possible strategy considered by many to ‘re-allocate’ more super into the tax-free component is something called a ‘re-contribution strategy’. This action can be most effective when you have a significant amount of your super as a taxable component. Re-contribution involves withdrawing a lump sum of your super (after you’ve met a condition of release, and meet eligibility requirements), pay any necessary tax on the withdrawal, and re-contributing these funds back into Superannuation as a ‘non-concessional’ contribution. Everyone’s circumstances and capacity for this strategy will be different, please speak to us regarding your eligibility.