Bonds

Click below to read the full report

Bonds

The Reserve Bank of Australia kept the cash rate unchanged at 4.10% this Tuesday under the first meeting with new Governor Michele Bullock. This has extended the rate pause for the fourth straight month. The Board again have stated inflation has passed its peak, but is still too high and is anticipated to linger for some time. Policymakers have warned that further monetary tightening may be needed to bring back inflation to the target range of 2% - 3% in late 2025. The committee reiterated any rate adjustment will depend upon how the economy behaves.

Source: www.tradingeconomics.com - Current Interest Rate, Australian 10year Bond Yield vs Australian 2year Bond Yield

With rates where they are, we thought now is a good time to share an educational piece on bond markets.

The bond market is a global market, almost twice the size of the share market. The US has the biggest bond market, followed by China, Japan, Europe, and the UK. The Australian bond market only makes up about 2% of the overall market.

What are Bonds?

Bonds and shares have similar characteristics, both types of assets are used by companies to raise capital from investors.

They are both offered in the primary market and then traded in secondary markets.

Their prices vary on a variety of factors such as economic and market influences, interest rates and inflation.

There are risks and premiums associated with both.

Whilst shares are a form of ownership, bonds are a type of loan. Bonds are mostly issued by governments, and sometimes companies and tend to be lower on the risk curve versus other asset classes, such as shares.

Bonds are distinguished between each other mainly by:

1.Maturity Date/Duration

This is the date and period of which the issuer will pay interest and return the principal to the current bond holder. Bonds with longer maturity dates typically offer higher interest rates, as investors are compensated for taking on more risk. The bonds set interest rates and is generally dependant on the current environment and prevailing interest rate when the bond is issued.

2.Credit Rating

This rating indicates the likelihood of a bond issuer to repay and meet the loan terms. Bonds with higher credit ratings are considered less risky and therefore usually offer a lower interest rate in order to attract investors’ funds. Whereas lower credit ratings are riskier, and therefore are usually required to offer higher potential returns as compensation for the additional risk taken.

3.Issuer

Bonds can be issued by a variety of entities from governments to corporations. Government bonds tend to be the safest type of bond, as they are backed by a credible source. Corporate bonds are riskier in this sense as the company has the risk of defaulting on the loan.

Mechanics of Bond Returns

Bonds can offer both income and the possibility of a capital gain or loss. Unlike shares, where dividends can vary, the income component of bonds is a fixed rate of interest, known as the coupon.

The coupon is paid regularly until the bond matures, where the bond holder will receive the original loan amount back, known as the principal.

Bonds can be traded (bought or sold) in the secondary market and don’t need to be held to maturity. Investors may decide to buy or sell to take advantage of price movements.

Bonds are often compared by their yield, which is the expected total return of the bond based on today’s market price held to maturity. This is where the capital component can fluctuate with market news such as current and projected interest rates.

The yield on bonds and their price generally has an inverse relationship. So if a bond price falls, the yield rises, and if the bond price rises, the yield falls.

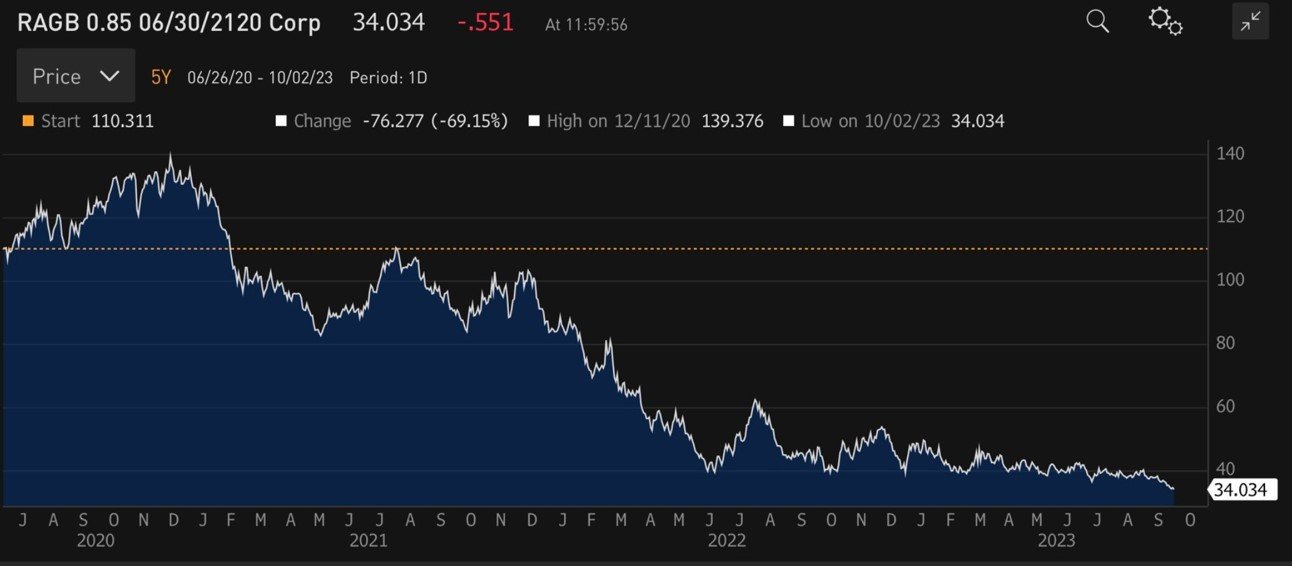

A great example of this is the Austrian government’s 100 year bond, issued in 2020 at a then juicy coupon of 0.85%. Investors fell over each other and threw €16 billion to the Austrians.

Since the issuance we’ve seen rates rise globally, and on Tuesday, the yield of the bond was around 3%, and its price has fallen below €33. That 67% price decline is a reminder to investors about duration risk, or the sensitivity of an asset to changes in interest rates. In the case of bonds, the longer the maturity, in simple terms, the greater duration risk.

Clearly, that made a 100-year bond, launched at a time when central banks were artificially suppressing interest rates, which is especially risky.

As bonds have a fixed income, largely lower volatility and generally move differently to shares, arguably this makes it a sensible diversifier to a portfolio, depending on your goals and risk preferences of course.

Broadly the role of a bond in a diversified portfolio is to:

Reduce portfolio volatility.

Preserve capital and defend against the impacts of inflation.

Offer liquidity and quick access to cash if needed.

Provide a consistent source of income.